The advantages of choosing Ambledown Gap Cover include, but are not limited to the following:

Finally, Ambledown Gap Cover offers a wide selection of optional extras like trauma counseling, motor hijack cover, internal prosthesis, and body repatriation.

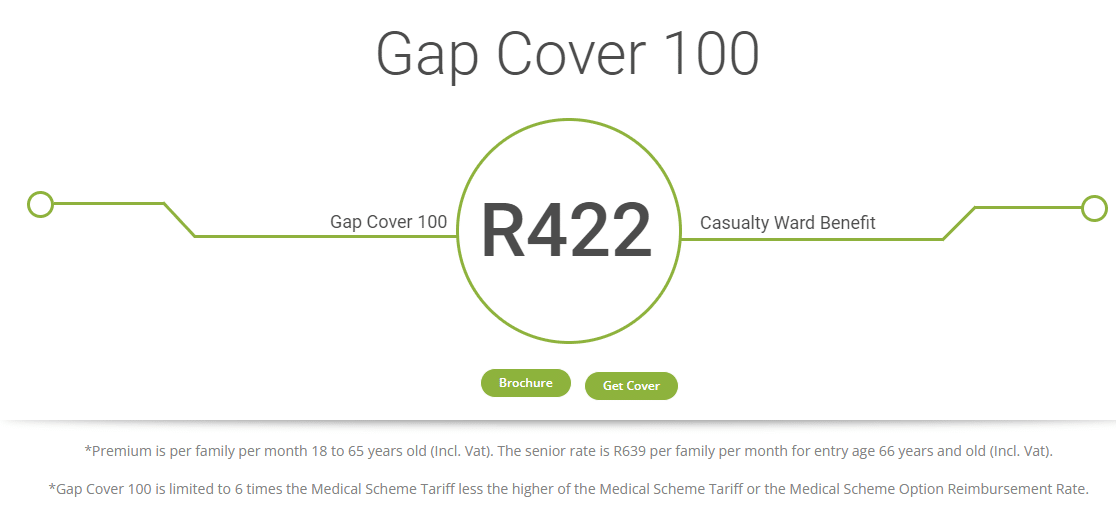

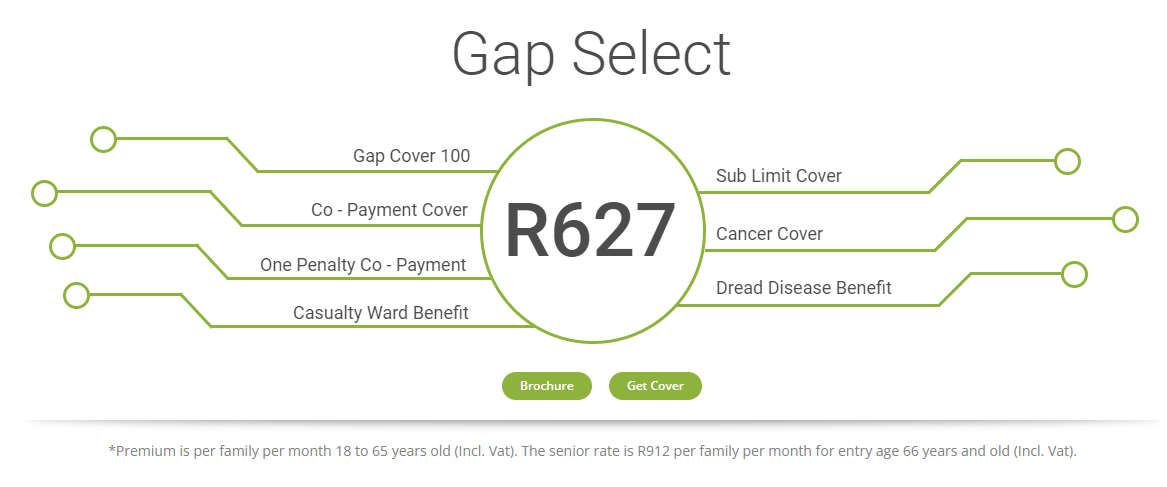

Gap Cover 100 provides 600% coverage.

Social Emotional Learning (SEL)

Online Caps support for Grades 10-12

Cambridge International Curriculum discount

Gap Cover 200 provides 300% cover.

Social Emotional Learning (SEL)

Online Caps support for Grades 10-12

Cambridge International Curriculum discount

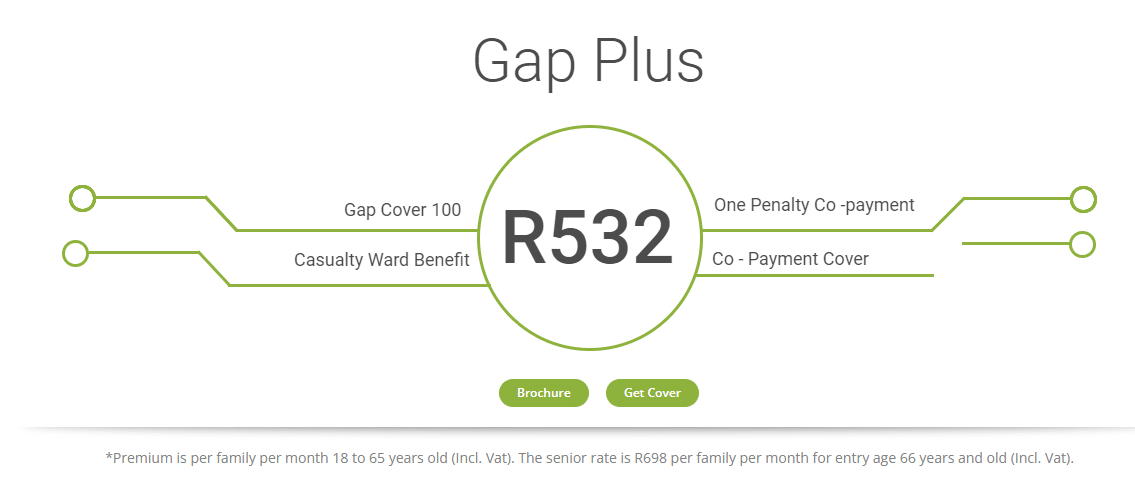

Gap Cover provides 600% coverage.

Includes a one-time payment per family per year to cover the penalty imposed by a medical scheme for using a non-network hospital.

Social Emotional Learning (SEL)

Online Caps support for Grades 10-12

Cambridge International Curriculum discount

Gap Cover provides 600% coverage.

Includes a one-time payment per family per year to cover the penalty imposed by a medical scheme for using a non-network hospital.

The benefit includes the following:

All tumors classified histologically as pre-malignant, non-invasive, or cancer in situ

Lymphoma with HIV

Kaposi’s sarcoma with HIV

Skin cancer other than malignant melanoma

Non-invasive cancer cells

Prostate or breast cancer in its early stages – Stage1 (T1a, N0, M0, G1)

Social Emotional Learning (SEL)

Online Caps support for Grades 10-12

Cambridge International Curriculum discount

Gap Cover provides 600% coverage.

Includes a one-time payment per family per year to cover the penalty imposed by a medical scheme for using a non-network hospital.

The benefit includes the following:

All tumors classified histologically as pre-malignant, non-invasive, or cancer in situ

Lymphoma with HIV

Kaposi’s sarcoma with HIV

Skin cancer other than malignant melanoma

Non-invasive cancer cells

Prostate or breast cancer in its early stages – Stage1 (T1a, N0, M0, G1)

Social Emotional Learning (SEL)

Online Caps support for Grades 10-12

Cambridge International Curriculum discount

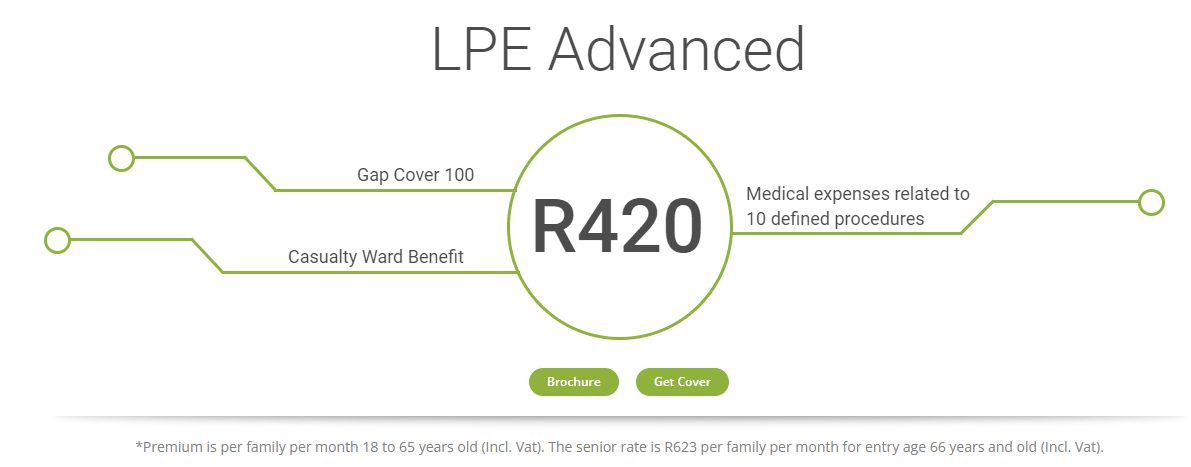

The Listed Procedures mentioned below are limited to the actual costs incurred, calculated at the Medical Scheme Rate, and subject to a specific limitation of R100,000 in aggregate per insured person per annum.

The defined listed procedures covered include:

In-hospital dentistry for impacted teeth for minors under 18 or reconstructive plastic surgery due to an accident during the cover

Oesophageal reflux and hiatus hernia surgery.

Neck and back surgery

Joint replacements, including but not limited to hips, knees, shoulders, and elbows

Cochlear implants, auditory brain implants, and internal nerve stimulators, including procedures, devices, and processors.

Varicose vein removal

Gap Cover 100 provides 600% coverage.

Social Emotional Learning (SEL)

Online Caps support for Grades 10-12

Cambridge International Curriculum discount

Includes a one-time payment per family per year to cover the penalty imposed by a medical scheme for using a non-network hospital.

The benefit includes the following:

All tumors classified histologically as pre-malignant, non-invasive, or cancer in situ

Lymphoma with HIV

Kaposi’s sarcoma with HIV

Skin cancer other than malignant melanoma

Non-invasive cancer cells

Prostate or breast cancer in its early stages – Stage1 (T1a, N0, M0, G1)

Social Emotional Learning (SEL)

Online Caps support for Grades 10-12

Cambridge International Curriculum discount

Here is a step-by-step guide on how to submit claims to Ambledown Gap Cover:

Ambledown may use your email address and telephone number to inform you of the claim’s progress.

To change your Ambledown Gap Cover option, you will need to follow these steps:

Cancel your previous plan to avoid being charged for two plans simultaneously.

To submit a claim for Gap Cover with Ambledown, follow these steps:

Payment will be made directly into your bank account if your claim is approved.

Your Gap insurance will not cover any costs you incur immediately. For example, accounts related to depression, emotional matters, or mental illnesses are typically not covered by gap insurance.

Rehabilitation for drugs or alcohol is typically not covered by a health gap plan unless specifically included in your PMB.

All applications for a new membership with Ambledown will be subject to a 3-month general waiting period. This is unless the claims qualify as an accident in terms of the policy definition or if the client changes gap cover policies with similar benefits offered by different product providers within the same insurer (GICL).

Additionally, a 12-month pre-existing clause will apply, excluding claims for any treatment received for a condition 12 months before the policy’s inception.

However, benefits will be payable once the membership is over 12 months, regardless of when the illness manifested, or the injury occurred.

If a member upgrades their cover, the additional benefits obtained will be subject to a 3-month general waiting period and a 12-month pre-existing clause.

However, the existing benefits enjoyed before the upgrade will not be subject to the waiting periods mentioned.

| 🔎 Gap Cover Provider | 🥇 Ambledown | 🥈 Stratum Benefits | 🥉 Sirago |

| 🟥 Number of Plans | 7 | 11 | 8 |

| 🟧 Average Price | R222 | R167 | R289 |

| 🟨 Waiting Periods | 3 – 12 months | 3 months | 3 months |

| 🟩 Exclusions | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟦 Oncology Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 In-Hospital Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟥 Out-of-Hospital Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟧 Maternity Benefit | None | ✅ Yes | ✅ Yes |

| 🟨 Scopes and Scans | ✅ Yes | ✅ Yes | None |

| 🟩 Co-payment Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟦 Emergency Room | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Accidental Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟥 Trauma Counseling | None | ✅ Yes | ✅ Yes |

| 🟧 Premium Waiver | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟨 Non-DSP Co-Payment | None | ✅ Yes | ✅ Yes |

| 🟩 Prostheses | None | ✅ Yes | None |

| 🟦 Accidental Death/ Permanent Disability | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Travel Cover Extender | None | None | None |

| ✅ Pros | ❎ Cons |

| Provides cover for in-hospital medical expenses that exceed medical scheme benefits, up to R185,837 per policy year | A 12-month waiting period applies to pre-existing conditions. |

| Covers co-payments for certain medical procedures | A 3-month waiting period applies to additional benefits obtained when a member upgrades cover. |

| Offers different plans to cater to various needs and budgets | Some plans have age limits for new members to join. |

| Provides emergency medical evacuation benefits | Certain conditions and procedures are excluded from cover. |

| Offers premium waiver benefits | No cover for out-of-hospital medical expenses. |

| Provides a medical second opinion service to members | No coverage for non-medical expenses, such as travel or accommodation. |

| Allows claims to be submitted up to 180 days or six months from the first day of treatment | No cover for cosmetic or elective medical procedures. |

Exceptional Support.

The gap provider demonstrated exceptional support to clients during a difficult period, specifically regarding claims affected by the Constantia liquidation. – Catherine du Toit

Professional and Efficient.

Ambledown Gap Cover proved professional and efficient when processing a childbirth-related claim, with payment made within 10 days. The service is recommended for those seeking reliable gap cover. – Tracy van Dyk

Excellent.

Amble down Gap Cover displayed excellent service delivery when addressing an incorrect claim submission. The Claims Operations Executive Manager contacted the client, and the claim was professionally handled and paid out. Ambledown Gap Cover is recommended to handle and resolve claims effectively. – Thembi Thompson

Ambledown Gap Cover offers a comprehensive range of plans to cater to various needs and budgets, such as the Amble Gap Cover 100, Amble Gap Cover 200, Amble Gap Plus, Amble Gap Select, Amble Gap Supreme, and Amble Gap LPE.

These plans cover in-hospital medical expenses exceeding medical scheme benefits, up to R185,837 per policy year. Ambledown Gap Cover also covers co-payments for certain medical procedures, provides emergency medical evacuation benefits, and offers premium waiver benefits.

Additionally, Ambledown Gap Cover provides a comprehensive range of value-added benefits, such as trauma counseling, motor hijack cover, internal prosthesis, and body repatriation, depending on the plan chosen.

Sharpen your knowledge with a better understanding of Medical Aid in SA

Ambledown Gap Cover is a form of insurance that covers medical expenses not fully covered by your medical aid.

Ambledown Gap Cover covers the shortfall between what your medical aid pays and what your medical expenses cost.

The cover offered by Ambledown Gap Cover can vary depending on the plan you choose but typically includes things like in-hospital expenses, co-payments, and medical scheme shortfalls.

Ambledown Gap Cover costs from R222 per month on the Guardian option.

Yes, Ambledown offers a variety of Gap Cover plans that you can customize based on your individual needs and budget.

Yes, Ambledown Gap Cover is designed to work with your medical aid, so you must have a medical aid plan to be eligible for Gap Cover.

To submit a claim for Ambledown Gap Cover, you can download the claim form from their website or request it from Ambledown directly. Complete the form and attach any required supporting documentation before submitting via email, fax, or post.

Ambledown aims to process claims within 10 working days of receiving all required documentation. However, this may vary depending on the complexity of your claim and any unforeseen delays.

The waiting period for Ambledown Gap Cover is typically three months for new members, but this may vary depending on your specific plan.

Yes, Ambledown Gap Cover has some exclusions, which may vary depending on your chosen plan. It is important to review the policy documents carefully to understand what is and is not covered.